The Lowdown on the Federal EV Tax Credit

April 20, 2017 | Katelyn Bocklund | Education

Earlier this week, Minnesotans who purchased a plug-in electric vehicle during 2016 were able to apply to receive a tax credit of up to $7,500 through the federal Plug-In Electric Drive Vehicle Credit under Internal Revenue Code Section 30D. If you’re thinking about purchasing a plug-in vehicle in 2017, chances are good that you’ll still be able to cash in on that deal, but it won’t be around forever.

Originally published under the Energy Improvement and Extension Act of 2008 and later amended in the American Recovery and Reinvestment Act of 2009, Section 30D provides a credit for qualified plug-in electric vehicles purchased after December 31, 2009 that includes passenger vehicles and light trucks. The credit ranges from $2,500 to $7,500 based on battery capacity. All Nissan, General Motors, and Tesla models, which are arguably the most popular EVs in Minnesota, offer the full $7,500 credit. There are a few models made by BMW, Audi, Ford, Hyundai, Kia Motors, Mercedes-Benz, Porsche, Toyota, and Volvo that do not offer the full $7,500 credit. If you’re looking to purchase an EV in 2017 from any of the above named manufacturers, be sure to check out the complete list of qualified vehicles and their credits before you shop so you can take advantage of the full credit.

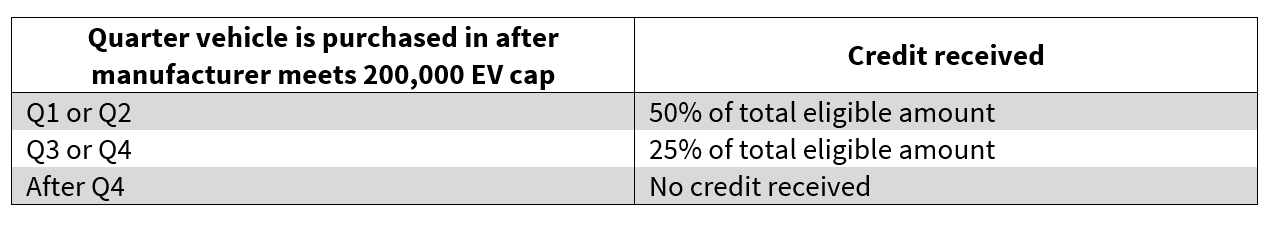

There are two caveats to the credit: 1) drivers can only claim the credit in the year that they begin driving their EV and 2) it starts to phase out when at least 200,000 qualifying vehicles manufactured by a manufacturer have been sold for use in the US, calculated on a cumulative basis on sales after December 31, 2009. For example, once Tesla’s cumulative sales reach 200,000 vehicles, the credit will begin to phase out for all Teslas sold after that point. The chart below explains more about the phase out period:

At this point, you might be wondering if any manufacturer is close to reaching the 200,000 vehicle mark. Our best guess is that Nissan and Tesla are close to reaching the phase out period, with Tesla hitting that mark even before it delivers on all the Tesla Model 3 pre-orders. However, we can’t be 100% sure since the IRS website does not provide comprehensive data. It only lists data for Ford, Mercedes-Benz, and BMW, but we know that other manufacturers have sold EVs in the US since 2009, especially Tesla, Chevy, and Nissan. From doing a bit of digging, the IRS site hasn’t been accurate for a long time, as reported by AutoBlog in 2014.

Our best advice? Purchase an EV as soon as you can to guarantee your chance at taking advantage of the federal EV tax credit in 2017.